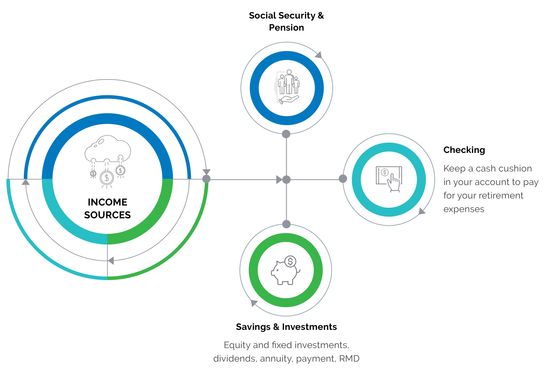

Retirement income planning entails converting a part of an individual’s accumulated assets into a reliable and systematic income stream during retirement. This complicated process requires an “income-planning specialist” that has access to specialized “financial tools” that help position you for a long and comfortable retirement.

Cameron Financial excels at creating custom strategies that position the assets inside your portfolio to generate necessary retirement income. You have made it to the “summit of the financial mountain”. Now it’s time to enjoy the view and start climbing down. Every mountain climber knows to get back down safely. We help you plan your “personal retirement descent”.

Visionary planning for the changing retirement world

Diversification, asset allocation, inflation protection are all essential concepts in successful retirement planning. In the 21st century, retirement income planning is entirely different, and retirees must realize that they cannot plan using the same strategies employed by previous generations.

Our parents and grandparents did not face the same risks — 0% interest rates, longevity risk, and finally, tax-rate risk, which include higher taxes during retirement.

Clients need a retirement advisor that can help them adapt to the changing retirement planning world. Manages your portfolio during retirement is entirely different from managing it in your working years. Work with a financial advisor who can show you the difference and help you plan for your next stage in life.